are hoa fees tax deductible in nj

Click here to learn more. Generally if you are a first time homebuyer your HOA fees will almost never be tax deductible.

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Homeowners associations are allowed a 100 deduction on taxable income and a flat rate of 30 applied.

. There may be exceptions however if you rent the home or have a home office. In cases like these the IRS deems HOA fees to be a. NJ Income Tax Property Tax DeductionCredit for Homeowners and Tenants.

Every homeowners association HOA is different but there are several situations in which you can deduct some or all of your HOA fees. If your property is used for rental purposes the IRS considers HOA fees tax deductible as a rental expense. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood.

If you live in your property year-round then the HOA fees are not deductible. Tax Tips for New Jersey HOAs and Condo Associations. However there are special cases as you now know.

To revoke an election requires the consent of IRS. Similarly are property taxes deductible in NJ. How you use the property determines whether the HOA fee is tax-deductible or not.

Are hoa fees tax deductible in nj. NJ Taxation The property tax deduction reduces your taxable income. However you might not be able to deduct an HOA fee that covers a special assessment for improvements.

While HOA fees arent tax deductible for your primary residence there are other expenses that are deductible. There isnt a limit on the amount of HOA fees you can deduct as a rental expense on Schedule E to offset your rental income. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the.

Though many costs of owning a home are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are considered an assessment by a private entity. Do you pay HOA fees for condos or townhouses. Because HOA fees are not deductible as a state or local tax the new 10000 limitation on state and local income taxes doesnt affect the deductibility of HOA fees.

The answer regarding whether or not your HOA fees are tax deductible varies depending on the situation. Tax season is always a stressful time of the year. But there are some exceptions.

The previous limit was 1 million and that amount still holds true. So lets go over when an HOA fee is tax deductible and when its not. What is tax deductible in NJ.

The IRS considers HOA fees as a rental expense which means you can write them off from your taxes. If the home is a rental property however HOA fees do become deductible. Homeowners can deduct property taxes paid or.

If the home is a rental property then you can deduct the HOA fees as a. As a general rule no fees are not tax-deductible. Additionally an HOA capital improvement assessment could increase the cost basis of your home which could have several tax consequences.

What kind of taxes do you pay when you sell a house in New Jersey. HOA fees are not tax deductible unless you have a dedicated home office or you are renting out your property. Filing your taxes can be financially stressful.

One of the questions HOA residents commonly ask is Are HOA fees tax deductible The answer though is not as simple. Are HOA Fees Tax Deductible. The answer is yes and no.

Yes you can deduct your HOA fees from your taxes if you use your home as a rental property. It does this with the help of HOA dues fees that the association collects from members. Are HOA Fees Tax Deductible.

Therefore if you use the home exclusively as a rental property you can deduct 100 percent of your HOA fees. You can deduct your property taxes paid or 15000 whichever is less. There are many costs with homeownership that are tax-deductible such as your mortgage interest and property taxes however the IRS will not permit you to deduct HOA fees they are considered a charge by a private individual.

However if you have an office in your home that you use in connection with a trade or business then you may be able to deduct a portion of the HOA fees that relate to that office. First though lets take a look at what an HOA is what they offer and what that can mean for you come April 15. Other municipalities are introducing legislation to get at least a portion of hoa fees to be tax deductible.

A few common circumstances are listed below. That should make everything a little more clear to you and help keep you out of trouble with the IRS. Generally HOA dues are not tax deductible if you use your property as a home year-round.

You can also deduct mortgage interest up to 750000 if it is a new loan. However if HOA fails to file Form 1120. If the home is a rental property however HOA fees do become deductible.

HOA fees are typically not 100 percent deductible but you may still be able to claim some portion of them as a writeoff. If you have purchased a home or condo you are likely paying a monthly fee to cover repairs and maintenance on the outside of your home or in common areas. You can deduct your property taxes paid or 15000 whichever is less.

HOA fees are often used to pay for maintenance landscaping and general upkeep of the community and common areas. Under the new tax law for 2018 you can deduct up to 10000 in state and property taxes. For the most part no but there are exceptions.

To revoke an election requires the consent of irs. In general homeowners association HOA fees arent deductible on your federal tax return. As a homeowner it is part of your responsibility to know when your HOA fees are tax-deductible and when they are not.

You may be wondering whether this fee is tax deductible. These fees are used to fund the associations maintenance and operations. Are HOA-fees deductible.

Yeah we know thats not a great answer but its true. You can reach HOA fees tax deductible status if you rent out your property either year-round or for a specific portion of the year. A homeowners association runs a community by imposing certain rules preserving its aesthetics and maintaining various aspects of the neighborhood.

You can deduct your rental property HOA fees under Other expenses Schedule E Line 19. For Tax Years 2017 and earlier the maximum deduction was. Unfortunately homeowners association HOA fees paid on your personal residence are not deductible.

Are property taxes deductible in NJ. An election to file Form 1120 H is done annually before its due date which is the 15 th day of the third month after a tax year. Though many costs of owning a home are deductible on your income taxes including your mortgage interest and property taxes the IRS does not allow you to deduct HOA fees because they are.

However if the home is a rental property HOA fees do become deductible.

Tax Tips For Homeowners Nj Lenders Corp

Are Hoa Fees Tax Deductible Clark Simson Miller

What Hoa Costs Are Tax Deductible Aps Management

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Homeowners Association Fees Tax Deductible

Are Hoa Fees Tax Deductible Clark Simson Miller

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

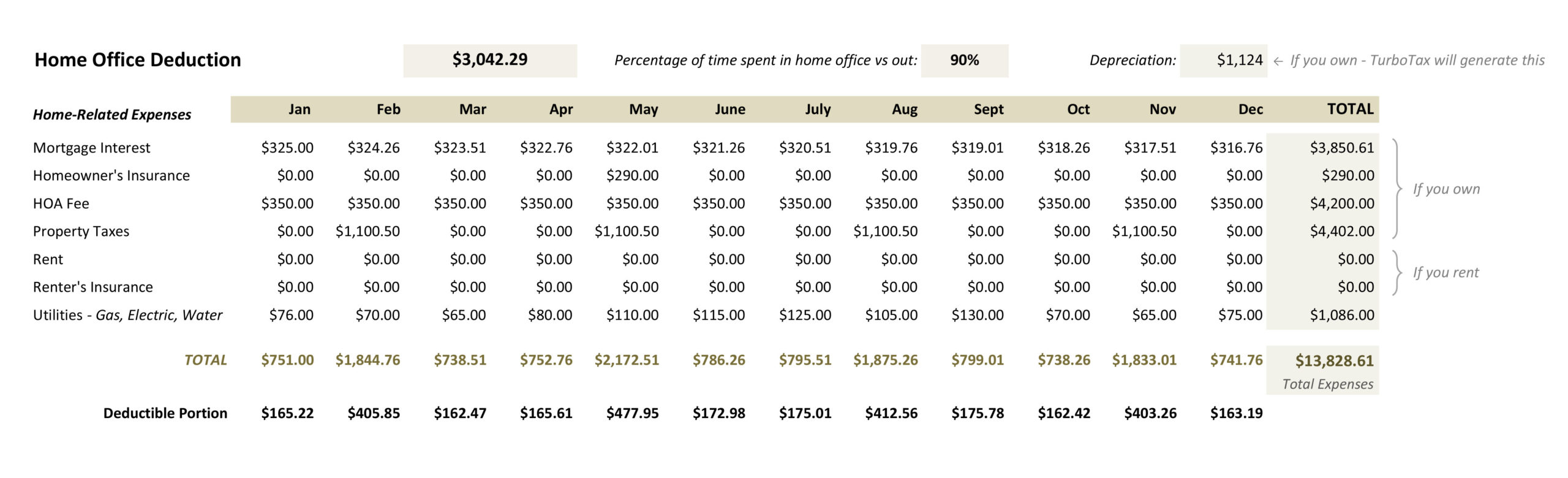

Calculating Your Home Office Expenses As A Tax Write Off Free Template Lin Pernille